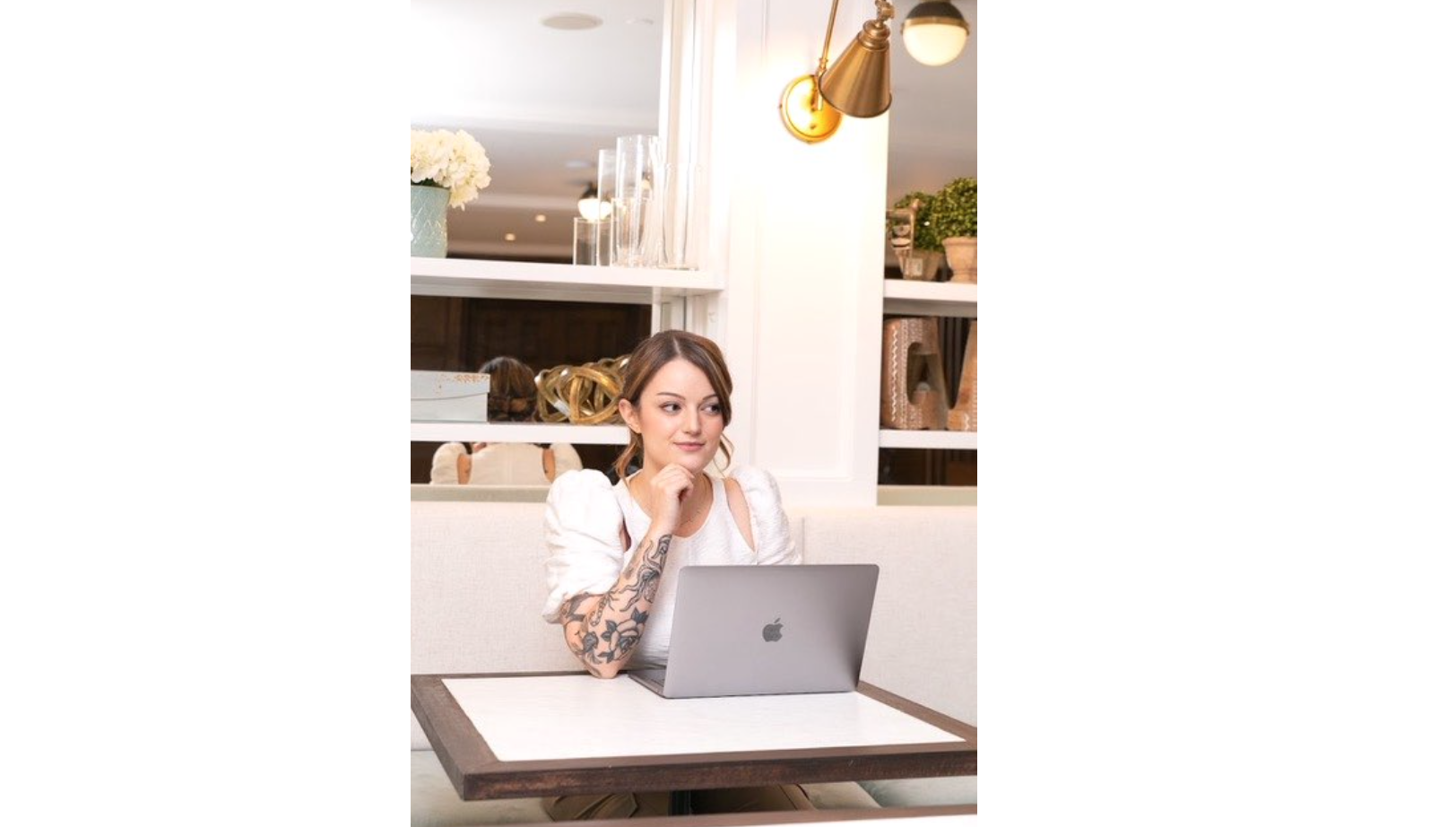

Kassandra Skoulikides | Building Seven Figure Wealth

Kassandra Skoulikides is a real estate investor and broker with Londono Group. She has transformed herself into a real estate expert over the last 6 years and has amassed a real estate portfolio of over seven figures to date. Despite having a challenging start, she did not let that stop her from doing the inner work and following her dreams. She is an advocate for empowering women; her story of grit and resilience but foremost of tenacity and hard work surpasses all odds. We loved interviewing her, and we know she is JUST getting started. Keep watching, and make sure to read her inspiring story below.

How long have you been with Londono?

I’ve been with them for six years now. It’s a very difficult industry to break into. When I started, I had no connections whatsoever, so it was especially challenging. I love what I do. Sometimes it feels almost surreal. You know, I’ll be on a beach somewhere and I’m able to manage my business from there, I get to make my own schedule, and I have a sense of freedom that I never felt in my life, not to mention an overwhelming sense of pride in my work. There’s an amazing feeling that comes with knowing that you’re good at what you do.

Take me back to before real estate. Were you in sales—or did you always know you would go into real estate?

God no, I never knew I was going to go into real estate. When I finished high school, I had no clue what to do. My family doesn’t have a big background in education—like I had one person at that point from each side of my family go to University. I didn’t know what I wanted to be. I studied film because I love movies, especially documentaries. I said, “I have a passion for that, so maybe that can turn that in to something.” I studied film for a year and a half and then I got offered a job with a film crew from Germany who were shooting in Montreal. I became good friends with the producer, and I ended up spending two years after that making documentaries with them overseas. In Germany, a few months in Bosnia and England. It was an amazing, crazy life experience and I learned a lot about myself, but I think that in doing that I also learned that while I have a passion for watching movies, I missed my home, I missed my friends. It was a ‘living out of a suitcase’ lifestyle and that wasn’t for me.

Where did that path take you to when you came back to Montreal?

When I came back, I said, “I don’t want to do this but am I seriously going to go back to school to study, and if so…what?” So, until I figured it out, I started working. I got a whole bunch of jobs. None of them really did anything for me until I started working in what I thought was going to be my ‘end of the road’ office job. I couldn’t imagine working a 9-to-5 desk job, but I said, you know, “it will be temporary. You’ll figure it out.” So, I got a job working for a property management company. The girl that they had renting their apartments ended up quitting to go back to school, so I started taking some of the rental phone calls, and discovered I was good at selling people over the phone and renting the apartments. They would call for one and ask If it’s available, I’d say “no, but we have this—you know what’s great about this building is that it has this and this.” I guess you know, one thing led to another, and I started renting apartments full time for them.

When you say that, did it come naturally, like a people skill? How do you develop that?

I guess part of it came naturally, but I’ve always liked a challenge. Every day was something new, something fun. I did really well. I rented a lot of their vacant apartments. I was going all over the place, and it worked for me because I really liked getting out of the office. I liked going to show apartments, but my commissions with them were $50 an apartment—not big money.

I had a little bit of an epiphany moment when I blew a tire on my car, and I didn’t know how I was going to pay for a new one. I thought to myself, “OK, I’m good at this. I’m good at this job. I’m good at what I do.” It honestly didn’t make sense my boss to pay me more than what they were paying me mind you, because they could pay someone else a small salary plus little bonuses and there are a ton of people who would be very happy with that. You know those people, they just want to punch in, punch out, pay their rent and enjoy their life. But for me, I wanted a little bit more. For example, I had bought myself a nice little car and you know, if I couldn’t afford a new tire on that car, then there’s a problem. I told myself “Why not make myself some serious money, instead of making another person rich.” Someone had recently told me, “Do you know what real estate brokers make when they rent an apartment? The commission is the first month rent.” So naturally, calculated how many apartments I rented that year for them—and it blew my mind. I was like “Oh my God, I could be making so much more. I should go get my real estate license.” So, I sold my nice car that I was so proud of. I sold it. I bought a scooter from some guy who was mad at his teenage son for drinking and driving. Instead of having caps over where the screws were, there were Budweiser beer caps hot glued onto it. It was so embarrassing. But I knew that, while virtual real estate classes were less expensive, I knew myself and knew I needed to go in person. I signed up for Lasalle College. So, I sold the car, I got the scooter and I still rented apartments on the side for my old boss here and there to kind of make ends meet and pay my rent.

How did you know that? Because you were studying it and learning about the industry?

I remember at the time the interest rates were a little high— and there were a lot of people saying, you know, “Is it better to rent now and buy later when the rates go down?” Obviously so many brokers were saying, “100% it’s better to buy” but they themselves were renting, and people knew they were renting! So, I was like, “How are you going to do one thing and tell your clients another? If you believe in something, and you’re capable of seeing it through, then put your money where your mouth is”. I always wanted to stand by what I was telling my clients. I still tell my clients now, if you don’t know where you want to go, or let’s say you’re in a relationship and you don’t know how that’s going to turn out or if there’s other factors other than just, you know, the money, then they take a take a moment and reflect on what’s best for you, but overall, I’m always going to say, “I invested in the stock market. I’ve invested in other people’s businesses, and so far the only one that has really paid off for me is real estate.”

I’m sure you can speak to clients now with such a different tone of confidence, giving advice, right?

Yeah. A big misconception is that if you buy an income property, an investment property, it has to be a ‘plex. A lot of first time investors think they have to start with a duplex or a triplex. I see so many people who work long hours at their jobs, they’re very busy, you know, or maybe they’re starting their families or they’re getting married etc etc; they have a lot going on their life and they go ahead and buy a duplex or triplex, and then they realize what it takes to maintain it. You know, pipes burst in the middle of the night, the roof needs to be changed, or there’s a high tenant turnover rate that demands a lot of attention and work. It turns into a big headache for these already busy people. They don’t have experience yet, and they burn themselves out, and then tell anyone who will listen, “You know what, I made a mistake. Real estate is not a good investment.”

I can explain the difference though—my first investment was a condo. I put 5% down. I lived in it for one year because that’s the CMHC says we have to do, and then I rented it out. I let it grow in equity. What I tell people is that there are so many different ways to make money in real estate without the headaches. With condos, what I love about them is you pay your condo fees and for the most part, things are taken care of. As long as you buy in a stable building, with good management, with a good reserve fund, it’s usually a pretty safe investment. While you’re living in it, make it as nice as you can, get nice furniture, decorate it, paint it—little things that are going to make it, “wow.” Then, you’re going to get professional pictures taken of it and when your time is up there, I guarantee you’re going to rent it out for top dollar. That’s going to cover all of your mortgage payment, your interest, your taxes, your condo fees. If you can break even, amazing, if everything can be covered, you’re golden. Your job is to sit on that property and let it build in value. So then, when you’re ready, you go buy your next one. If you have your down payment already for your next purchase, amazing, cool, do it! Say you bought that condo for $200k and 2 1/2 years later, it’s worth 275—you can refinance that and pull up to 90% of the equity from it, which could also be your down payment on another place.

How do you manage your portfolio and growing assets?

Where do you think, right now, is the best place to be investing in Montreal?

So you’re saying to go a bit further out in the outskirts?

I’m obsessed with the fact that you are under 30 and know this much about real estate investments—your portfolio at 40 is going to be wild, right?

What’s the lifestyle for you? I mean, you can’t really turn your phone off or anything— real estate around the clock.

Do you have an actual day that you do that?

Another thing is so many entrepreneurs push that getting up at 5:00 AM and going to the gym for 5:30 AM and getting all these things done before the sun’s up. So many preach that this is the best way to be successful. Honestly, I have a lot of respect for people who can do that, but it took me a long time to accept it’s not for me, it’s not how I am most productive. I still sometimes wake up early, but I have my coffee. I’ll look at my emails, and take my time to myself. I try not to waste time on social media during the day, so if I’m going to browse Instagram or whatever, I do it in the morning. I need that time to myself. I would rather work late at night, I’m honestly way more productive at 9PM than 9AM. It took me a while not to have the guilt associated with not being up and out of the house at 7:00 AM.

How do you manage your personal life and work balance?

At the end of the day, I know that I have my properties to fall back on, no matter what. It takes a huge stress off my shoulders, this is why I invest my money. My work and my properties, by my 30th birthday, they will have made me well over $1,000,000. Honestly, I could have made me a lot more—there were some opportunities that came up that I let slide, but I learned from those mistakes.

What is success to you?

Follow @MTL.realestate.girl on Instagram for more!

Visit KassandraSkoulikides.com

Photo Credits – Peter Mac Photography

Get your hands on the latest tips and tricks of what it means to be a #GOSS. In this free e-book you will dive into 11 business traits that will help you grow your business!

11 Ways To #BeGossy E-book

FREE DOWNLOAD

Find out more inspiring stories from women worldwide of all industries. Follow us on Instagram @GossMagazine.

website design Credit

© Goss Club Inc. 2024 | all rights reserved |

Inspiring & empowering women worldwide.

© GOSS CLUB INC. 2024 | all rights reserved

Share to: